Taxes On Gambling Winnings In New York

The tax imposed under section 3402(q)(1) and this section shall not apply with respect to a payment of winnings which is made to a nonresident alien individual or foreign corporation under the circumstances described in paragraph (c)(4) of this section or with respect to a payment of winnings from a slot machine play, or a keno or bingo game. In most cases, the casino will take 25 percent off your winnings for the IRS before paying you. Not all gambling winnings in the amounts above are subject to IRS Form W2-G. W2-G forms are not required for winnings from table games such as blackjack, craps, baccarat, and roulette, regardless of the amount.

When you gamble, you’re probably only focused on winning in the moment. You don’t think about what the government might take off the top of your wins.

Of course, the US federal government always wants a cut. It demands 24% of your winnings through federal taxes.

Tax On Casino Winnings In New York State

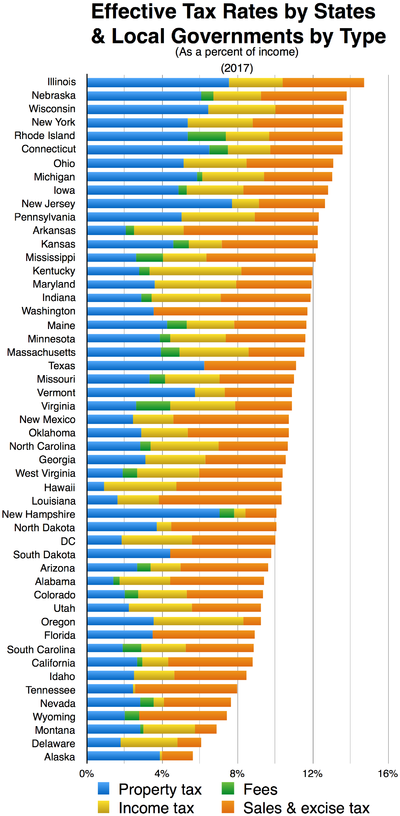

However, states vary on how they tax gambling income. Some are much worse than others due to their high rates.

Casino Gambling Taxes by State

The following guide covers seven states that want a big chunk of your winnings. It also discusses common questions and topics regarding gambling and taxes.

California:

The California casino scene is a thriving land-based gambling industry. It offers 62 tribal casinos, 88 card rooms, and over a dozen horse tracks.

That said, California is definitely a good vacation spot due to its weather and numerous gaming options. But you might take pause on visiting here when considering the extreme tax rate.

California taxes gambling wins as normal income. It collects anywhere from 1% to 13.3% of your winnings. The 13.3% is the highest state tax rate in the US.

Iowa:

Iowa boasts casinos, poker rooms, and sports betting. It charges a 5% flat tax on winnings earned in the Hawkeye State.

Minnesota:

Minnesota offers a wide range of charity gambling establishments and a lottery. The Gopher State may not provide massive Vegas-style resorts, but it does give you some options.

It taxes gambling according to four income brackets (based on married people’s income):

- 35% ($0 to $39,410 annually)

- 05% ($39,410 to $156,570)

- 85% ($156,760 to $273,470)

- 85% ($273,470 and above)

You’ll likely fall into the 5.35% bracket if you do profit through gambling. But if you win really big, you’ll need to deal with the large 9.85% rate.

New York:

Gambling in New York has grown within the past decade. Its Expanded Gaming Act has added commercial casinos on top of the existing tribal establishments.

You can also enjoy lotteries and poker here too. Assuming you win, though, then you must ante up between 4% and 8.82% for state taxes.

Oregon:

The Beaver State offers lotteries, charity gaming, horse racing, and tribal casinos. It provides more than enough gambling options for its 4.22 million residents.

Oregon doesn’t worry about taxing wins worth less than $600. However, it does impose an 8% tax on winnings worth over $600.

Vermont:

Vermont features a unique tax structure that varies based on your winnings. You’ll pay a 6.72% rate on wins worth less than $5,000, and 6% on wins worth over $5,000.

Wisconsin:

Wisconsin features 22 tribal casinos and lotteries. The Cheese State requires up to 7.65% in taxes on gambling winnings.

Should You Avoid States With High Gambling Taxes?

You don’t necessarily need to avoid states with high gambling taxes—especially when you’re interested in a certain casino or sportsbook. However, you should keep this matter in the back of your mind.

Of course, you also want to take other factors into account besides taxes. Here are aspects to think about when determining what state you’ll gamble in:

- Convenience/distance – You don’t want to drive for hours just to avoid gambling taxes.

- Quality of gambling venues – Playing at the best casinos/poker rooms/sportsbooks can make dealing with high stakes worthwhile.

- Availability of regulated online gambling – You may be focused on using legal online casinos and betting sites above all.

- Your preferred stakes – You probably don’t need to worry much about higher taxes if you’re just playing quarter slots or $5 blackjack.

What If You Don’t Live in the State Where You Win?

Gambling over state lines causes confusion on where to pay taxes. Do you pay your home state or the one where you win?

Typically, you cover taxes in the state where the winnings occur. Your home state, meanwhile, will give you a tax credit for whatever is paid to the other state.

Here’s an example:

- You live in Oregon near the California border.

- You cross the border and buy a lottery ticket at a CA gas station.

- You win a $1 million prize.

- As per California’s tax laws, the $1 million payout is subject to the highest 13.3% rate.

- You pay $133,000 to the Golden State.

- Oregon only features an 8% tax rate on large gambling wins.

- Therefore, you owe nothing to the Beaver State.

Don’t Forget Federal Taxes

Some states don’t require you to pay any taxes on gambling winnings. These states include:

- Alaska

- Delaware

- Florida

- Nevada

- New Hampshire

- South Dakota

- Texas

- Washington

- Wyoming

You must pay federal taxes on wins no matter what—even if you live in a state with no gambling taxes. Again, Uncle Sam wants 24% of your winnings.

This percentage is already significant. It becomes even more noteworthy in a state like California, where you could pay up to a 37.3% total tax (24 + 13.3).

You report gambling wins under the “other income” on Form 1040. The government expects you to report winnings even if you earn just $1.

Of course, you can almost assuredly get away without reporting a tiny payout. However, a gambling establishment requires you to fill out a W-2G form on big prizes.

Casinos, poker venues, and sportsbook issue W-2G’s under the following circumstances:

- $600 and above for horse gambling and sports betting wins worth 300x your stake (e.g. $3,000 win / $10 bet = 300x).

- $1,200 and above for slots and video poker wins.

- $1,500 and above for keno wins.

- $5,000 and above for poker-tournament wins.

Remember to Deduct Your Casino Losses

The IRS wants you to report all gambling winnings under any circumstance. State governments that tax gambling payouts expect the same.

However, you can deduct any losses incurred as well. You itemize deductions in a different section of your tax form than where the other income is reported.

Your deduction will be subtracted from whatever you win. Here’s an example:

- You win $4,000 at a casino.

- You lose $3,000 while winning this amount.

- You must report the full $4,000 under “other income.”

- The $3,000 goes under itemized deductions.

- $4,000 – $3,000 = $1,000.

- You’d pay the relevant tax rate on $1k.

More on Itemized Deductions

Itemized deductions constitute expenses that you spend to win money. They differ from a standard deduction, which is basically a lumpsum that’s subtracted from your income.

Standard deductions are easier to deal with. Unfortunately, you must use the itemized variety when concerning gambling.

If you’re an amateur gambler, meals, hotel stays, entertaining, and gas/plane tickets don’t count as deductions. You must be a professional gambler to deduct items like these. Instead, you can only count what you spend on gambling.

Keep Casino Gambling Records

You should keep track of your gambling winnings and casino bankroll as best you can. This way, you have evidence just in case the IRS audits you.

When keeping records, you want plenty of information. Here’s an example of five important things you can jot down in your records:

- Type of gambling/game

- Date of gambling session

- Location of the sportsbook/poker room/casino

- Bankroll at the start of the session

- Bankroll at the end of the session

In addition to tracking this info, you should also hold onto other documents that you receive. Bank statements, betting tickets, check copies, and W-2G forms are examples of documentation.

What If You Don’t Pay Taxes on Gambling Winnings?

You may be tempted to avoid reporting winnings from gambling—especially if the money is insignificant. You’ll likely get away with doing so provided you haven’t won big enough to receive a W-2G form.

Of course, I don’t advise failing to report gambling winnings. But you definitely don’t want to avoid reporting wins after receiving a W-2G.

A gambling establishment sends a W-2G copy to the IRS. The latter can easily check this information with their software.

If the IRS catches you not reporting taxes, they’ll probably just send a letter and fine you. However, they can take further action if you refuse to cover the taxes.

Conclusion

Claiming gambling winnings on your taxes varies greatly from one state to the next. Some don’t charge you a dime while others level a large amount.

Of course, you may not really care about the state tax beforehand. If you do win, though, you’ll feel the sting in a state with a high tax rate.

You don’t necessarily need to drive hours away just to avoid high taxes on winnings. However, you might consider taxes if you live near the border of two or more states.

California, Minnesota, New York, Oregon, and Wisconsin are currently the five places with the highest rates. If possible, you should avoid these states when gambling for mid or high stakes.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

This article was fact-checked by our editors and Christina Taylor, MBA, senior manager of tax operations for Credit Karma Tax®.

Hit it big playing the lottery? You’re probably thinking about how you’ll spend all that sweet cash. But first, Uncle Sam is going to want his cut.

The Internal Revenue Service considers lottery money as gambling winnings, which are taxed as ordinary income. The total amount of tax you pay on your lottery winnings will depend on multiple factors, including the state where you live and whether you take the winnings as a lump-sum payment (one check for the full amount after taxes have been withheld) or an annuity (smaller annual payments that are paid out and taxed over time).

Although you probably won’t be able to completely escape the tax man, you may be able to offset taxes on lottery winnings by claiming deductions you qualify for. Here are some things to know about paying federal income taxes on lottery winnings. Keep in mind tax rules may vary for state and local income taxes, so for the purposes of this article, we’re talking about federal income taxes only.

Do I have to pay taxes on lottery winnings?

The IRS considers most types of income taxable, unless the tax code specifically says it’s not. Because lottery winnings are considered gambling winnings, which are definitely considered taxable income, the IRS will want its cut.

For lottery winnings, that means one of two things.

- You’ll either pay taxes on all the winnings in the year you receive the money — for winnings paid out as a lump-sum payment.

- Or you’ll pay taxes only on the amount you receive each year — for winnings paid as an annuity.

Take note: If you receive interest on annuity installments that haven’t been paid to you yet, that interest must be included in your gross income for the tax year you received it.

How will the IRS know about my lottery winnings?

If your winnings are $600 or more, the lottery agency is supposed to give you a Form W-2G that you’ll have to file with your federal income tax return if the agency withheld federal income tax from your winnings.

The lottery agency is also required to send a copy of this form to the IRS if your winnings are $600 or more, so it’s important to accurately report your winnings on your federal tax return.

And even if you don’t receive a W-2G for your lottery winnings (or other type of gambling payouts), you’re still expected to report those winnings as income on your federal tax return.

How could winning the lottery affect my taxes overall?

Getting a huge financial windfall can be life-changing, but it doesn’t change everything — you’ll still have to pay taxes and bills. Federal and state taxes can decrease the amount of money you ultimately receive, so it’s crucial to understand taxes on lottery winnings when you strike it big.

Whether you’re all-in on your prize money and accept it as a lump sum or you’re receiving payments over time, winning the lottery generally increases your income. Taxes are calculated based on your taxable income for the year, so if the extra income from lottery winnings moves you into a higher tax bracket, you’ll typically end up paying more income tax.

If you fail to report taxable income (including lottery winnings) on your tax return, you could owe additional tax, interest and even penalties.

What is the tax rate for lottery winnings?

Depending on where you live, you may need to pay taxes on lottery winnings to your state and local governments in addition to the federal government.

Federal tax

Right off the bat, lottery agencies are required to withhold 24% from winnings of $5,000 or more, which goes to the federal government. But, depending on whether your winnings affect your tax bracket, there could potentially be a gap between the mandatory withholding amount and what you’ll ultimately owe the IRS.

Even if your lottery winnings don’t boost your tax bracket, if the federal government withheld too much tax on your lottery winnings, you might get a refund at tax time.

State and local tax

Each state has its own rules on taxing lottery winnings, so check both your state’s tax website and your city’s tax website for information. For example, if you live and win in New York City, the state government will withhold 8.82% and the city will withhold another 3.876% — on top of your base federal withholding of 24%.

Seven states — Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming — don’t have income tax, so big winners in those states won’t pay state taxes on prize money. Some other states don’t have a state lottery at all.

And three more states — California, New Hampshire and Tennessee — exclude their state lottery winnings from taxable income. But before you play the lottery in a different state, check the rules so that you know whether any taxes will apply to your winnings.

Should I take a lump sum or annuity payments?

Whether you get to choose between a lump sum or annual installments for your lottery payout can depend on different factors, like state lottery rules and how much you won. Either way, here’s how the two payout types will affect your federal income taxes.

Taxes On Casino Winnings In New York

Lump-sum impact

Receiving your winnings as a single lump sum could potentially bump you right into the highest bracket for the tax year in which you win the lottery. That would mean if you win a very large amount, your income over a set threshold ($518,401 for single taxpayers and $622,051 for married couples filing jointly, for 2020) would be taxed by the IRS at 37%.

“If you decide to have a lump sum payment, that would probably put you in the higher tax bracket for that one year,” says Megan McManus, CPA and owner at Megan McManus, CPA.

For example, if you’re single and your current taxable income is $40,000, a $1 million lottery payout, taken in a lump sum, would increase your total income to $1,040,000 for the tax year. At the federal level, the portion of your income over $518,401 would be taxed at 37%. But all the lower tax rates would also apply to portions of your income less than that threshold. Here’s what you’d pay (rounded to the nearest dollar).

- 10% on income up to $9,700 = $970

- 12% on the next $29,775 = $3,573

- 22% on the next $44,725 = $9,839

- 24% on the next $76,525 = $18,366

- 32% on the next $43,375 = $13,880

- 35% on the next $306,200 = $107,170

- 37% on the last $529,700 = $195,989

If you add all that up, your total federal income tax obligation for the year would be $349,787.

Annual payments impact

Depending on your income, receiving annual payments will also likely affect your tax bracket — but the immediate financial impact could be less.

“The annuity payments would probably allow you to be in a lower tax bracket each year,” McManus says.

Let’s look at the above scenario with the same amount of lottery winnings broken out into 30 annual payments of about $33,333.

With the annuity approach, your taxable income would increase to just $73,333 in the year you won the lottery (assuming other factors like a wage increase didn’t boost your taxable income). The highest federal tax rate that would apply to your income would be just 22%. Here’s what you’d pay (rounded to the nearest dollar).

- 10% on up to $9,700 = $970

- 12% on the next $29,775 = $3,573

- 22% on the remaining $33,858 = $7,449

Your total federal income tax obligation for the year in which you win would be just $11,992.

Learn more about the marginal tax rate and what it means for your winnings.

How can I offset federal taxes on lottery winnings?

If you’ve won the lottery, the IRS expects you to report it as income on your tax return. And Uncle Sam is going to want his share whether you receive your winnings as a lump sum or annual payments. But there are ways to try to offset the increased tax obligation your lottery winnings will cause.

Claim deductions

Deductions are dollar amounts the IRS allows you to subtract from your adjusted gross income, or AGI, if you meet the requirements. This lowers your taxable income, which in turn can reduce your tax obligation. Here are two possible deductions (if you itemize).

- Charitable donations — You may be able to deduct the value of your charitable contributions from your income as long as the organization is a qualified tax-exempt organization — but certain conditions and limits apply. For example, you can only deduct cash donations that are equal to no more than 60% of your AGI.

- Gambling losses — You can deduct your gambling losses (like the cost of lottery tickets that you didn’t win on) as long as they don’t exceed the winnings you report as income. For example, if you report $1,000 in winnings but you have $2,000 in losses, you can only deduct $1,000.

Play the lottery in a pool

If you join a pool with others to buy lottery tickets, then any potential lottery prizes will be smaller because you’re sharing it — but your tax hit will be smaller, too.

“You’ll only be taxed on your portion of the income,” McManus says, “so if you receive a third of the winnings, you would only pay tax on that third.”

To make sure you’re taxed correctly, document how much of the winnings go to each person in your group. Ask the lottery agency to cut checks for each person in the pool instead of having one person collect and distribute the winnings. This may help ensure you only pay taxes on the amount you actually receive.

What’s next

Winning the lottery could change your life by giving you a certain level of financial freedom. But before claiming your prize, consider speaking with a financial or tax adviser who can help you understand the potential tax impact of your winnings and plan the best way to manage your windfall.

Consider how you plan to use the money.

“If you want to buy a house or put your kids through college, you might need the funds now, as opposed to taking annual payments,” McManus says.

But if your objective is to ensure a steady stream of income, annual payments may be more appealing to you.

Whether you receive your lottery winnings as a lump sum or annual payments though, you’ll still have to pay the federal government — and possibly your state and local government — their share of your winnings. So it’s important to have a plan for how to best save, invest and grow the winnings you’ll keep.

Relevant sources: Topic No. 419 Gambling Income and Losses IRS: Publication 538 New York Lottery General Rules IRS: Pay As You Go, So You Won’t Owe

Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She codeveloped an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s degree in business administration/accounting from Baker College and an MBA from Meredith College. You can find her on LinkedIn.